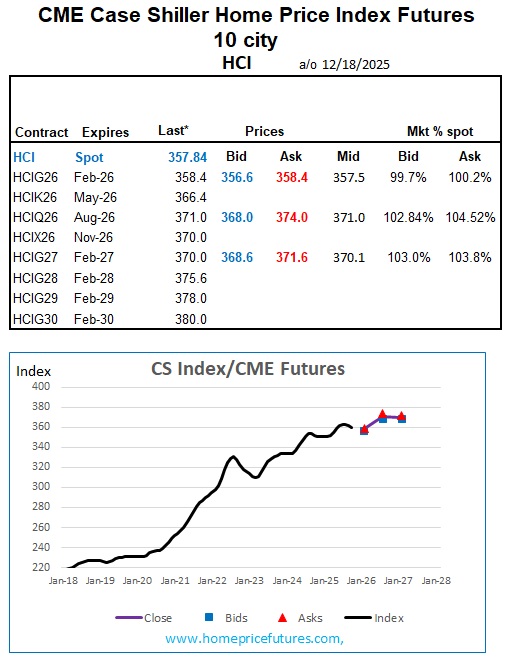

Notice: I'll be traveling from Dec 22 to Jan 17 and will be taking a break from market making. I have populated quotes on Feb '26, Aug '26, and Feb '27 contracts (see below) that should work through Case Shiller update on Dec 30.

Separately, I have a request into the CME asking them to offer a market-making program for the Feb 2030 contract, so that users can opine on longer-term trends. Anyone care to participate if they open that role?!?

Welcome to this forum on home price index derivatives. I’m John H. Dolan, an independent market maker for the CME S&P Case Shiller (home price index) futures.

My goal is to use this site to facilitate greater discussion of, and better understanding by academics, regulators, policy makers, rating agencies, traders and all interested parties in housing transactions (e.g. buyers, sellers, lenders, MBA, NAR), in the markets for home price index products, how they can be traded, and how to interpret observed market prices.

In particular I’d like to have the press focus more on forward expectations (instead of just reporting on historical data).

I’ve launched an OTC trading of other home price indices (see HPHF page), to include areas not covered by CME Case Shiller futures contracts, or more geographically smaller regions (e.g. Minneapolis, Dallas, Salt Lake)

Please feel free to email me with questions or suggestions (use "Get in Touch" button below. You can join the discussion on LinkedIn (the “CME Case Shiller Home Price Futures” group), and/or sign up for Twitter updates (mostly on trade notices) at @HomePriceHedges.

My hope is that greater awareness and more contributions from other traders, and a willingness by traders and hedgers to dabble in these products, that better liquidity will evolve for futures on this critically important financial market.

In my mind, these markets should be viewed as a community effort where opinions can be expressed and debated. Contributions, whether outright orders, spread quotes, or ideas to either side of the debate would be appreciated.